Cost of Living Impacting Employment Decisions

Posted on May 31st, 2023

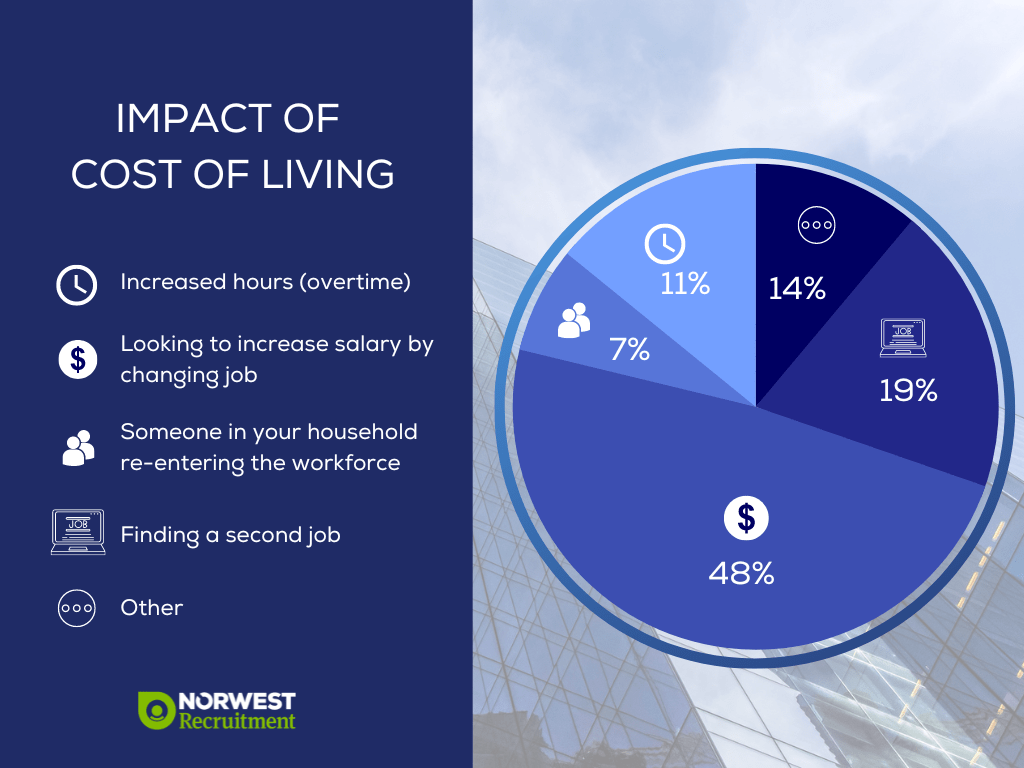

Norwest Recruitment recently conducted a survey with their employees database asking about the impact of the cost of living on their lives and the decisions they are making regarding their employment. We received a huge response from 646 people. Interestingly, the results revealed a significant 48% are looking for a new job to increase their salary, this is followed by 19% looking for a second job, 11% seeking increased hours by overtime and 7% said someone in their household, either their partner or themselves were looking to re-enter the workforce. The ‘Other’ comments formed 14% where the most popular comment was budgeting, followed by asking for a pay increase and moving house/location.

The results of this survey provide important insights into how these factors can affect businesses. As almost half of the responses indicate looking for a new job, we will focus on how this could impact businesses.

Talent Retention and Recruitment

The high percentage of candidates looking to increase their salary by changing jobs highlights the importance of competitive compensation in attracting and retaining top talent. Employers need to be aware that employees are actively seeking better-paying opportunities elsewhere. To mitigate the risk of losing valuable employees, companies should regularly review their renumeration packages and benchmark them against industry standards. Offering competitive salaries, along with other attractive benefits and perks, can help retain skilled employees and make the organisation more appealing to potential candidates.

Cost of Employee Turnover

When employees leave a company to pursue higher-paying opportunities, businesses face the cost of employee turnover. This includes recruitment expenses, onboarding and training costs for new hires, and the potential productivity loss during the transition period. By addressing salary concerns proactively and ensuring that employees feel recognised, businesses can reduce turnover rates and minimise the associated costs.

Impact on Workforce Productivity

Employees who are dissatisfied with their current salary may experience reduced motivation and engagement in their work. This can ultimately impact their productivity and performance. By proactively addressing salary concerns and offering opportunities for salary growth and advancement within the organisation, businesses can foster a more motivated and engaged workforce. Regular performance evaluations and opportunities for skill development and promotion can help employees see a clear path for career advancement and salary increases, reducing the likelihood of seeking job changes solely for financial reasons.

Employer Branding and Reputation

A company’s reputation as an employer can be influenced by its approach to compensation. Businesses that are known for offering competitive salaries and valuing employee financial well-being are more likely to attract top talent and build a positive employer brand. However, if employees perceive that their salary concerns are not being addressed, it can have a negative impact on the company’s reputation and ability to attract and retain skilled professionals. It is crucial for businesses to prioritize fair and competitive compensation practices to maintain a positive employer brand image.

Market Competitiveness

The survey results serve as a reminder that the labour market is dynamic, and employees are actively seeking better-paying opportunities. To remain competitive, businesses must continually assess market trends and ensure that their compensation packages align with industry standards. Regular salary benchmarking and analysis can help businesses identify potential gaps and make necessary adjustments to attract and retain top talent.

By addressing salary concerns and offering competitive compensation, businesses can enhance talent retention, reduce turnover costs, improve productivity, and maintain a positive employer brand image in a competitive job market. If you are starting to see any of these trends in your business, contact us for a confidential chat on 02 8853 4111. We can assist you with talent acquisition, salary benchmarking and market insights.

Hire an Accounting Professionals to get through this EOFY

Posted on May 18th, 2023

Hiring an accounting temp can be a beneficial strategy to help your business navigate the end of the financial year (EOFY). Here are 7 reasons on how hiring an accounting temp can assist your business during this period:

- Extra workforce: An accounting temp can provide additional resources and support to your existing finance team during the busy EOFY period. They can help manage the increased workload associated with financial reporting, reconciliations, and compliance tasks.

- Expertise and experience: Accounting temps often possess specialized knowledge and experience in financial reporting, tax compliance, and other relevant areas. They can bring fresh perspectives and insights to your business and help ensure that your EOFY processes are accurate and efficient.

- Flexibility and scalability: Hiring an accounting temp offers flexibility in terms of the duration and scope of their engagement. You can bring them on board for the specific period required, whether it’s a few weeks or a couple of months, and scale their involvement based on your business needs.

- Immediate availability: Accounting temps are readily available, allowing you to quickly fill staffing gaps or handle unexpected absences within your finance team. This ensures that your EOFY preparations and tasks remain on track and deadlines are met.

- Cost-effectiveness: Hiring an accounting temp can be a cost-effective solution compared to hiring a full-time employee. You can save on long-term expenses such as salaries, benefits, and training costs, especially if you only require additional support during the EOFY period.

- Knowledge transfer and upskilling: Accounting temps can share their expertise and knowledge with your existing team, contributing to their professional development. This knowledge transfer can help your internal team members improve their skills and gain insights into best practices in financial management.

- Focus on core activities: By delegating specific EOFY tasks to an accounting temp, your core finance team can focus on strategic activities and day-to-day operations that drive business growth. This division of responsibilities can enhance overall productivity and efficiency within your finance department.

We have several tried and tested temporary Accounting Professionals to help your business get through this EOFY. To book a temp today contact us at Norwest Recruitment on 8843 4111 or visit the Book a Temp page on our website.